Low or no-alcohol beverages: Innovation, Value, R&D trends, and Technology

In the last decade, consumers have become increasingly health-conscious, and as a result the food industry has been completely transformed. Vegetarianism is on the rise, raw and unprocessed foods are taking centre-stage, and consumers are taking a keen interest in foods with additional health and nutrition benefits.

Will this food revolution also signal a change in consumer drinking habits? Low and no-alcohol beers currently make up around only 2% of overall beer consumption, but industry analysts have begun to speculate that the move towards health and wellness could make the so called “low and no” segment one of the fastest-growing categories in beer.

AB InBev has said it wants 20% of its global beer volumes to come from low and no-alcohol by 2025—and now has zero-alcohol varieties of its global brands. Heineken has launched a no-alcohol variety of its eponymous brand in Europe, and demand for low and no-alcohol beers is also growing in South-East Asia.

Market reports can only tell us so much about innovation within this category. To find out what products and techniques brewers are actually working on, we can look to intellectual property (IP) data for insights. The recent patent activity from innovators in this field reveals signals about how this market and its technologies are evolving.

What can you learn about low and no-alcohol beverage development and brewing processes, from patented technologies and filing trends? What will the market look like in 2020? Can your company find game-changing partners or potential acquisitions? Who are the new entrants to the market? Should you be wary of any of them?

The results of a patent search query investigating low or non-alcoholic fermented or distilled beverages show the current of innovation is flowing in the direction of some big trends—and we found hidden gems in the undercurrents too.

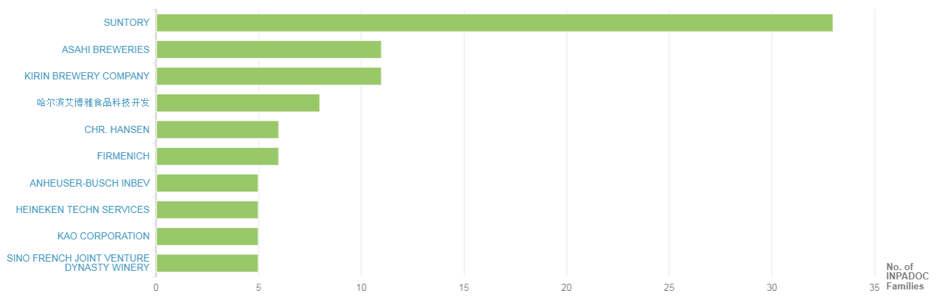

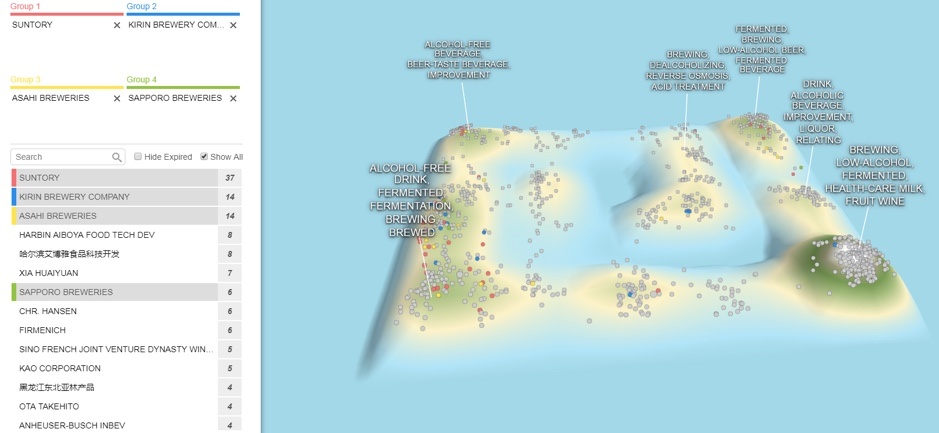

Which companies are working in this technology area?

The list of top 10 patent-intensive companies in this area is perhaps unsurprisingly led by Suntory, with a broad innovation footprint across 33 INPADOC patent families.

Japanese companies Asahi Breweries and Kirin Brewery Company also feature strongly. Kirin Brewery Company often does not refer to “beer” in its patents, instead describing “Effervescent beverage containing grain”, “malt beverage having reduced wort” and “refreshing carbonated beverage containing grain decomposition products with foam”. This may be an attempt to conceal the real subject matter of some of its patents.

Interestingly, the 5th company on this list, Chr Hansen A/S, is not a global brewing powerhouse but a Danish bioscience company which develops natural ingredients for the food, beverage, and dietary supplement industries. This may signify that competition in the low and no-alcohol beverage space may come from unexpected industries – or it could even lead to some interesting new partnerships.

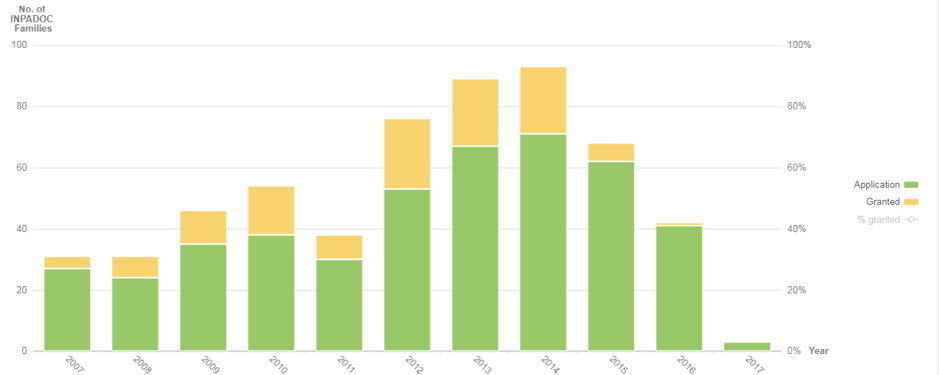

Innovation and filing trends

Insights by PatSnap shows you, among other things, the rate of patent filing in a specified area of interest. These could represent technologies developed by competitors or potential partners, and reviewing the filing trends over time may provide a gauge of how early or mature a certain technology area is.

From the graph above it is immediately obvious that there has been significant growth in filing activity in the low and no-alcohol beverage area over the last 10 years.

Recent patents include Asahi’s patent US20170245526A1, “Method for producing a non-alcoholic beverage” which describes a process of adding a sulfur-containing compound to an unfermented beer-tasting beverage to improve the flavour characteristics.

Chr Hansen A/S, the bioscience company mentioned previously, has filed several patents in this technology area in 2017. US20170226451A1, filed in January 2017 and published in August 2017 is particularly interesting, as it describes how the “Pichia kluyveri” yeast strain has unexpectedly been shown to have a similar flavour profile to a 4% / vol alcohol beer, but with a low or zero-alcohol content.

The patent states: “In particular, Pichia kluyveri yeast strains only use the glucose in the wort, and have the ability of converting this substrate into a high concentration of specific flavor compounds, which are normally produced by Saccharomyces ssp. yeast strains used for the brewing of beer. In this way the Pichia kluyveri yeast strains can be used to produce either a low alcohol or alcohol-free beverage, depending on the glucose levels in the wort.”

This yeast strain or related strains may warrant further investigation as “Pichia kluyveri” is also mentioned in a number of patents recently filed by Anheuser Busch Inbev SA.

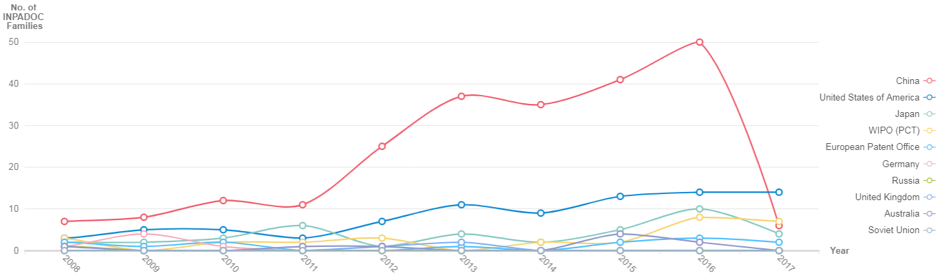

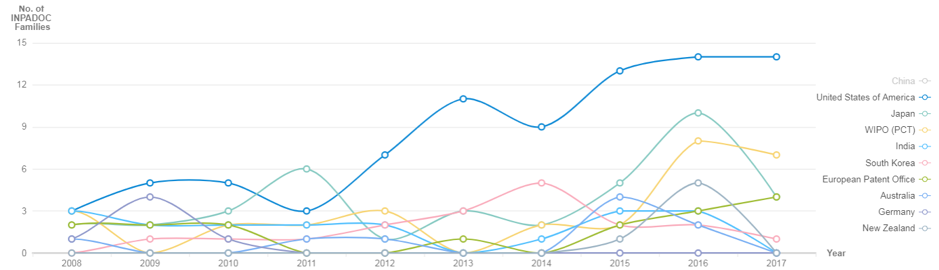

Annual Geographic filing trends

When reviewing the patent filing strategies of companies in a specific area of research, it is helpful to understand which markets are the main focus for technology development and commercialisation.

The chart below shows that the biggest increase in patent filings in recent years has come from filings with the Chinese patent office. This may suggest latent demand for low and no-alcohol beverages in this market, and closer inspection reveals a wide variety of beverages are described, ranging from fruit ciders to mead.

When the Chinese trend line is removed from the chart we can see sustained filing activity at the US patent office, as well as an uptick in activity in Japan and WIPO patent filings.

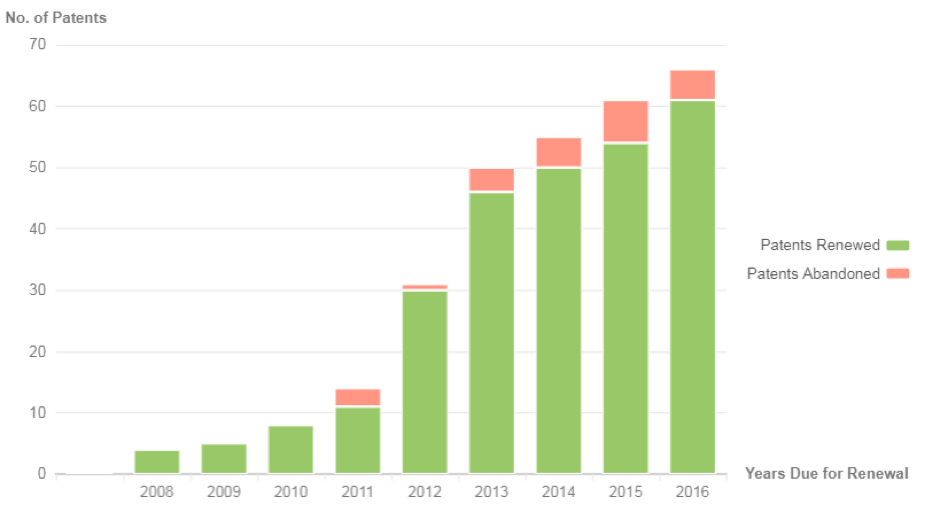

Abandonment rate

The abandonment rate in a given technology area can indicate whether a technology is emerging, or show that technology area has peaked and is now in decline. It can also reveal which processes, technologies or methods have failed, giving unique insights into the research and strategy of competitors.

Reviewing the abandonment rate for patents published in this technology area within the last 10 years quickly reveals some of the patents that are no longer in force.

For example, Kirin Brewery Company’s patent CN102469829B “Alcohol-free beer-like malt beverage and method for producing same” was published in 2014 but abandoned in 2016 after non-payment of fees. This patent has been valued at over $500,000 USD, so it could warrant further investigation to understand why this particular patent has been withdrawn.

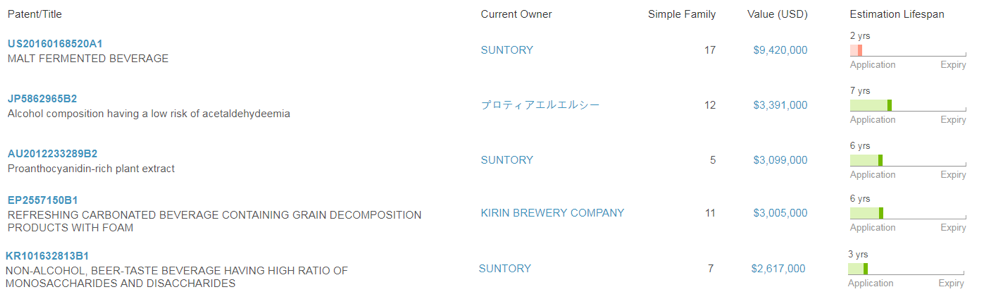

Highest market-valued patents

Identifying and understanding the highest-valued patents within a field can indicate which technologies and concepts hold the greatest growth potential.

This Insights by PatSnap report also shows when highly-valued patents are set to expire, empowering you to exploit these technologies once IP restrictions lapse.

Reviewing the 5 most valuable patents in this space reveals a recently published and extremely valuable patent owned by Suntory: KR101632813B1 “Non-alcohol, beer-taste beverage having high ratio of monosaccharides and disaccharides.” This patent is part of a large family, with filings at many different patent authorities, which means that Suntory has made a significant investment in protecting this innovation.

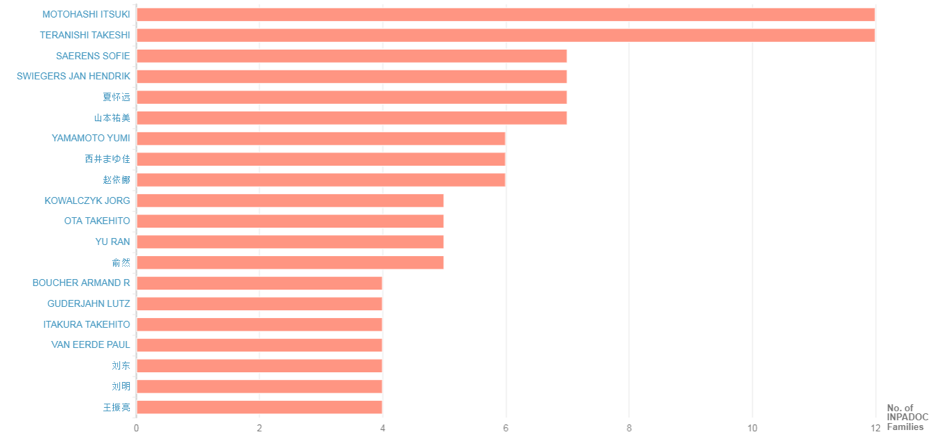

Top inventors

Insights by PatSnap reveals the top inventors in any field, potentially catalysing recruitment or partnership opportunities.

Reviewing the top Inventor by number of INPADOC families, we can see which researchers are most prolific and potentially generate a list of domain experts in any given technology area.

The two named inventors on Suntory’s patent KR101632813B1 are Takeshi Teranishi and Itsuki Motohashi. These inventors are quite prolific, as they have been named on around 40 Suntory patents across 12 INPADOC families since 2012.

Sofie Saerens and Jan Hendrick Swiegers also appear to be colleagues, as they are named on the previously mentioned Chr Hansen A/S patents for low-alcohol beer using the Pichia Kluyveri yeast strains.

Further down the list of top inventors is Jorg Kowalczyk, who works in innovation at Sudzucker AG, the largest European Sugar producer. He is named on a number of patents which describe the manufacture of beer using Palatinose (Isomaltulose) as a sweetener.

Technology landscape

Patent landscaping is a 3D, topographical representation of the patents within a technology space, giving you a 360° view over any area of interest. The peaks indicate areas with a high patent count, while valleys and“white spaces” represent areas with minimal patent filings and unexplored frontiers.

In the landscape above, we can see that the most densely populated technology area relates to low alcohol health drinks and fruit wines. These are mostly irrelevant to our interest in low alcohol-beers, so we can group them and exclude them from our analysis.

By highlighting all related Suntory patents in red, we can see that their patents mostly relate to alcohol free drinks and flavour improvements, as well as to low-alcohol beers. Asahi’s patents, highlighted in yellow, lie close to Suntory in these three areas of the landscape, while Kirin Brewery’s patents are much more widely scattered across the landscape, suggesting that they are developing a smaller number of solutions but across a broader range of technology areas.

About this report

This report was designed and created by the PatSnap marketing team, using the Boolean search parameters:

(IPC: (C12H3 OR C12G OR C12F OR C12C12/04 OR A23)) AND (“low alcohol” OR “noalcohol” OR “non alcohol” OR “alcohol free” OR “zero alcohol”) NOT (IPC:A61K) NOT (IPC:C12N9/26) NOT (IPC: A23L1/20) NOT (IPC: A23K) NOT (A23L1/034) NOT (TAC: “food”) NOT (GLUCOAMYLASE) NOT (Glycoside) NOT (“ethyl alcohol”) NOT (“hulupones”)NOT (CPC: C07C403/16) NOT (IPC: A01N37/16) NOT (TAC:”chocolate”) NOT (TAC:”seed”) NOT (TAC:”edible”) NOT (TAC:”saffron”) NOT (TAC:”wax”) NOT (TAC:”container”) NOT (TAC:”wasabi”) NOT (TAC:”beans”) NOT (IPC: A23L1/08) NOT (IPC: C12P7/06) NOT (IPC:A23L1/01) NOT (IPC: A23L5/10) NOT (TAC:”spore”) NOT (TAC:”meat”) NOT (TAC:”butter”) NOT (IPC: C12J) NOT (TAC:”lipid”)

We encourage you to modify and improve upon these rudimentary parameters, so you can uncover even more insights.

Free eBook: Using patent data to beat markets and competitors

This guide covers:

- How to use patent data at every stage of the R&D life cycle

- How patent data can be used to unlock new opportunities

- How to use patent data to assess the patentability of your invention

Download it here: The R&D Guide on Using Patent Data to Beat Markets & Competitors

Your recommended content

-

Patsnap Releases 2023 Global Innovation Report: The Brilliant Names to the Dynamic Landscape of Innovation

Category: Article | Category: eBook | Category: Research Tag | Category: Whitepaper

Wednesday, November 15, 2023

The Global Innovation 100 and Global Disruption 50 transcend individual entities, each representing a small innovation ecosystem with numerous subsidiaries. Through the innovation data of these companies, we gain insights into the characteristics, structures, and trends of global innovation.

-

Patsnap’s 2023 Disruption 50: A Closer Look at Tomorrow’s Innovators

Category: Article | Category: eBook | Category: Research Tag | Category: Whitepaper

Wednesday, November 15, 2023

Through active growth, the Global Disruption 50 have quickly established solid technology quality and profound technology influence that are comparable to that of the Global Innovation 100.

-

Impact of Patsnap’s 2023 Global Disruption 50

Category: Article | Category: eBook | Category: Whitepaper

Wednesday, November 15, 2023

The 2023 Global Disruption 50, 30% of which come from the Information Technology sector, are shifting the world’s innovation focus from a physical world of Atoms, to a digital world of Bits, and then a “world of Atoms empowered by Bits”.